owner draw report quickbooks

Enter the account name Owners Draw is recommended and description. Create a Prior year draws account at the beginning of the next year.

To create an owners draw account.

. For tax purposes it often helps to know how much the owner has taken in draws for the current year. Write Checks from the Owners Draw Account. Owners draw balances Tap the Gear icon and choose Account and Settings.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks-----Please watch. Click Save Close. Expenses VendorsSuppliers Choose New.

Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here. Then choose the option Write Checks. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

In this section click on the Owner. Click Equity Continue. Go to Settings and select Chart of accounts.

If your business is formed as a C Corporation or an S Corporation you will most likely receive a paycheck just like you did when you were employed by someone else. You can either enter a checkexpense and use. Create an Owners Equity account.

1 Create each owner or partner as a VendorSupplier. 2 Create an equity account and categorize as Owners Draw. Before you can pay an owners draw you need to create an Owners Equity account first.

Enter and save the information. From the Account Type dropdown choose Equity. In QuickBooks Desktop software.

If not go to your chart of accounts to create a new account and select equity as the type. In the Chart of Accounts window select New. Select Chart of Account under.

Click on the Banking menu option. Heres how you create an Owners Equity account. You should already have an owners draw account if you selected sole proprietor when setting up quickbooks.

From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account. In fact the best recommended practice is to create an owners draw. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

One way to do this is to make a general journal entry at the start of each year transferring the balance in the owners draw account into a separate owners draw. Answer 1 of 5. I just want a report on owners draw.

To Write A Check From An Owners Draw Account the steps are as follows. In the Write Checks box click on the section Pay to the order of. At the bottom left choose Account New.

Quickbooks Job Costing Job Wip Summary Report Quickbooks Data Migrations Data Conversions

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Getting Started With Quickbooks Advanced Reporting Youtube

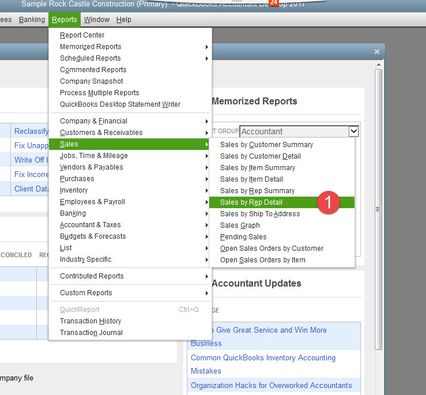

Solved Sales Report That Shows Sales Orders Each Individual Rep Has Written For A Fiscal Year

Quickbooks Help How To Create A Check Register Report In Quickbooks Youtube

Qodbc Desktop How To Run A Trial Balance Report In Qodbc Powered By Kayako Help Desk Software

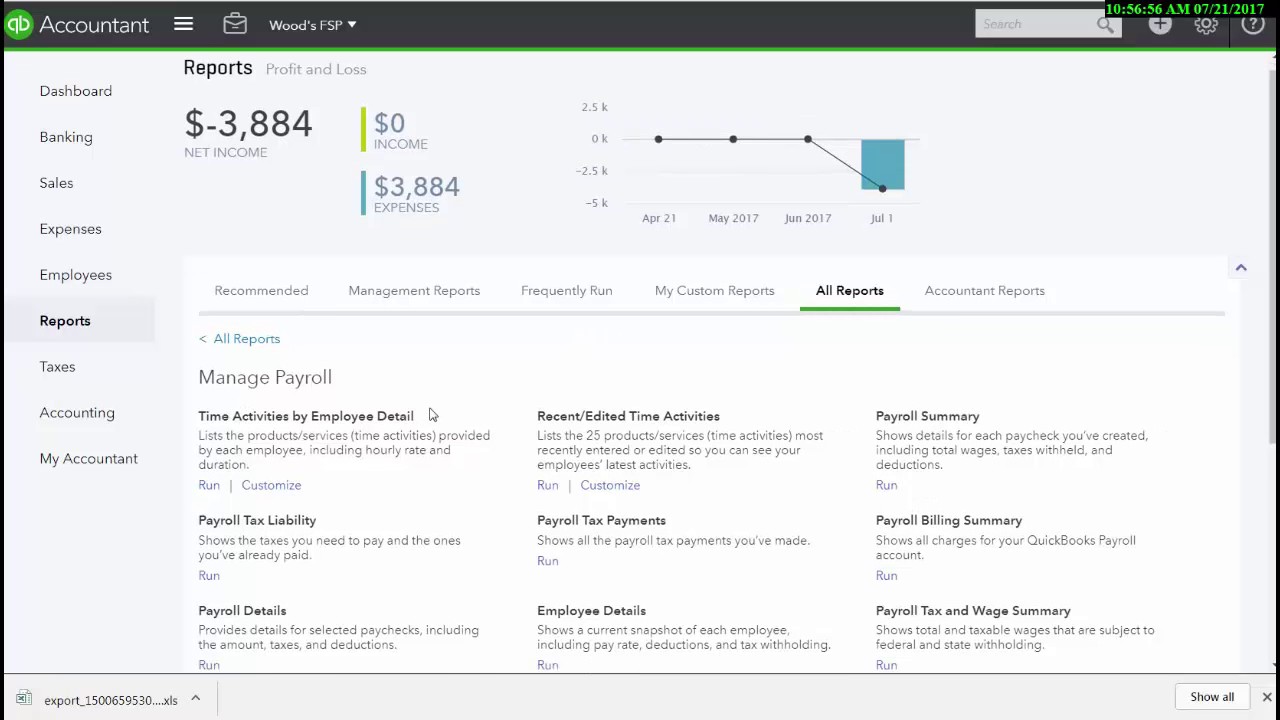

Quickbooks Online Full Service Payroll Report Navigation Youtube

Progressive Invoices Quickbooks Create Invoice Sample Resume

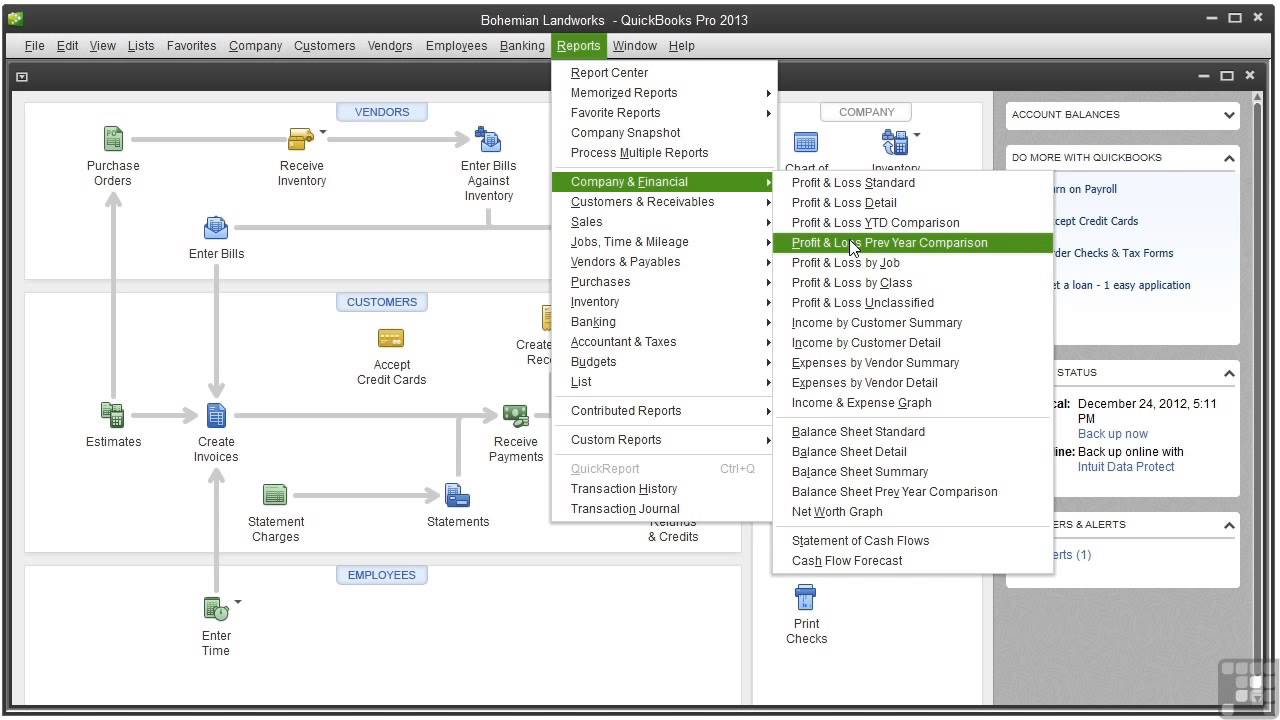

Quickbooks 2013 Tutorial Profit And Loss Report Youtube

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

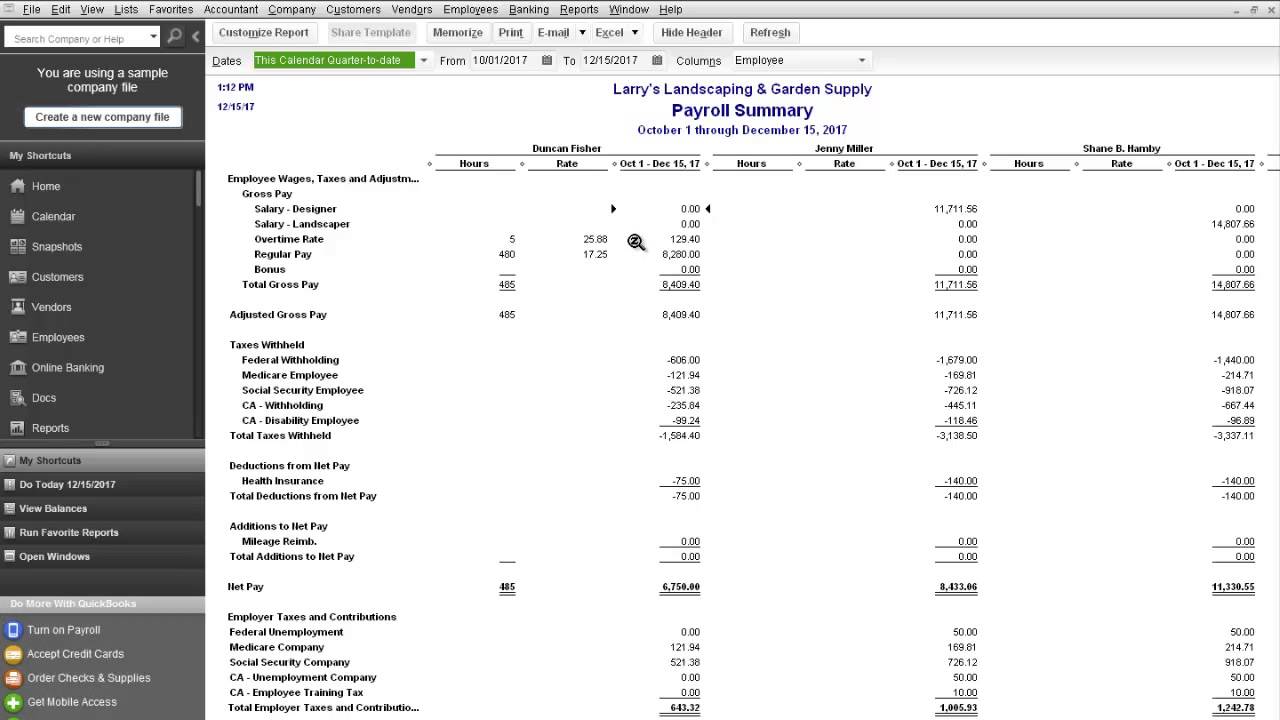

Rppc Inc Quickbooks Payroll Summary Report Youtube

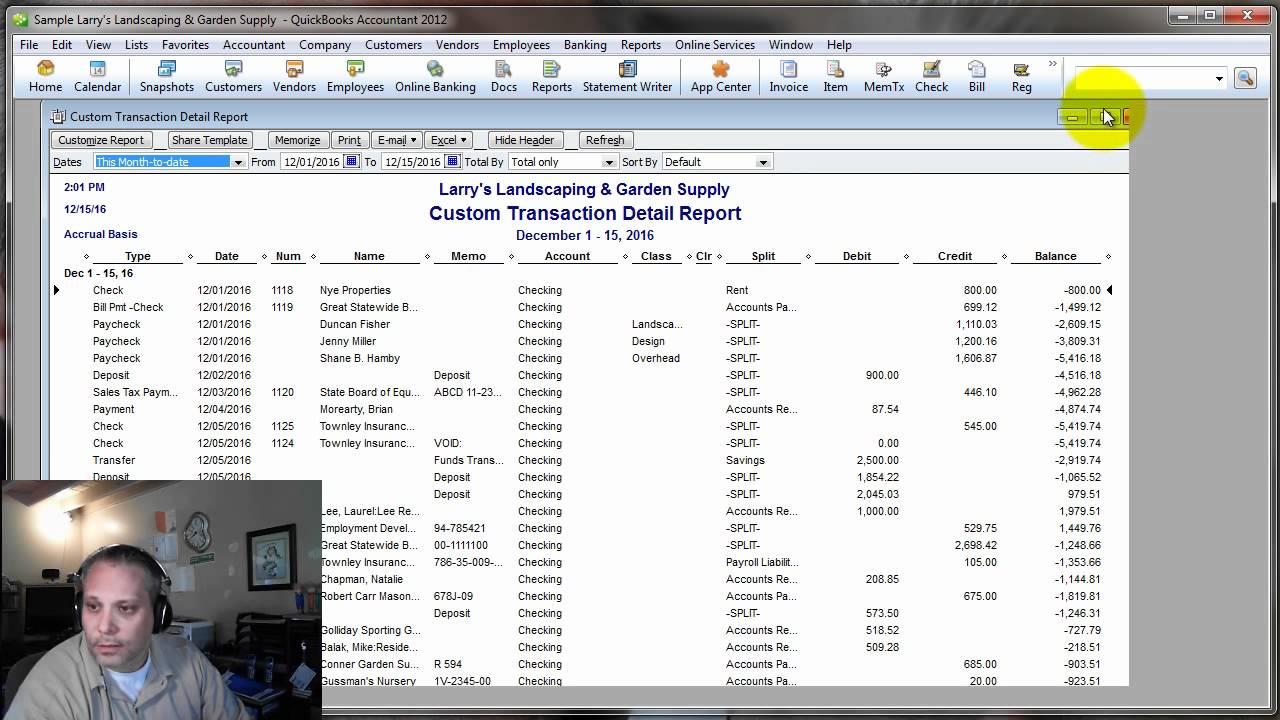

Solved Transaction Detail By Account Report

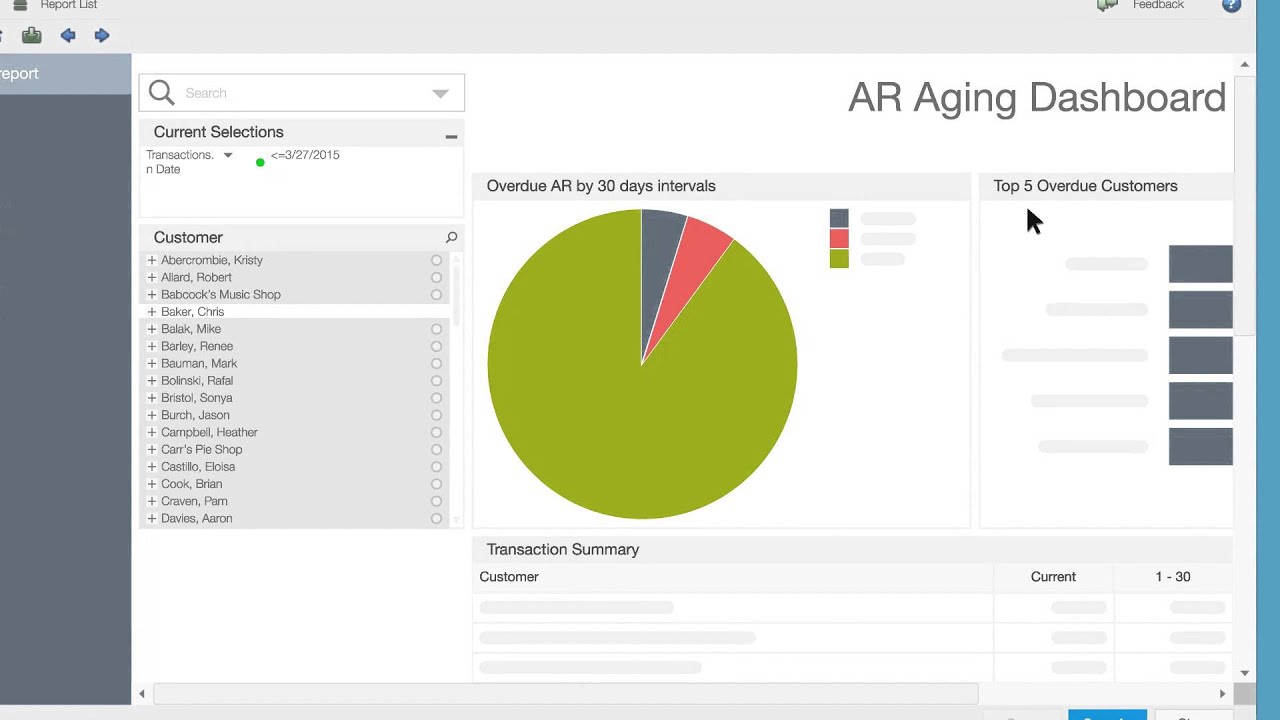

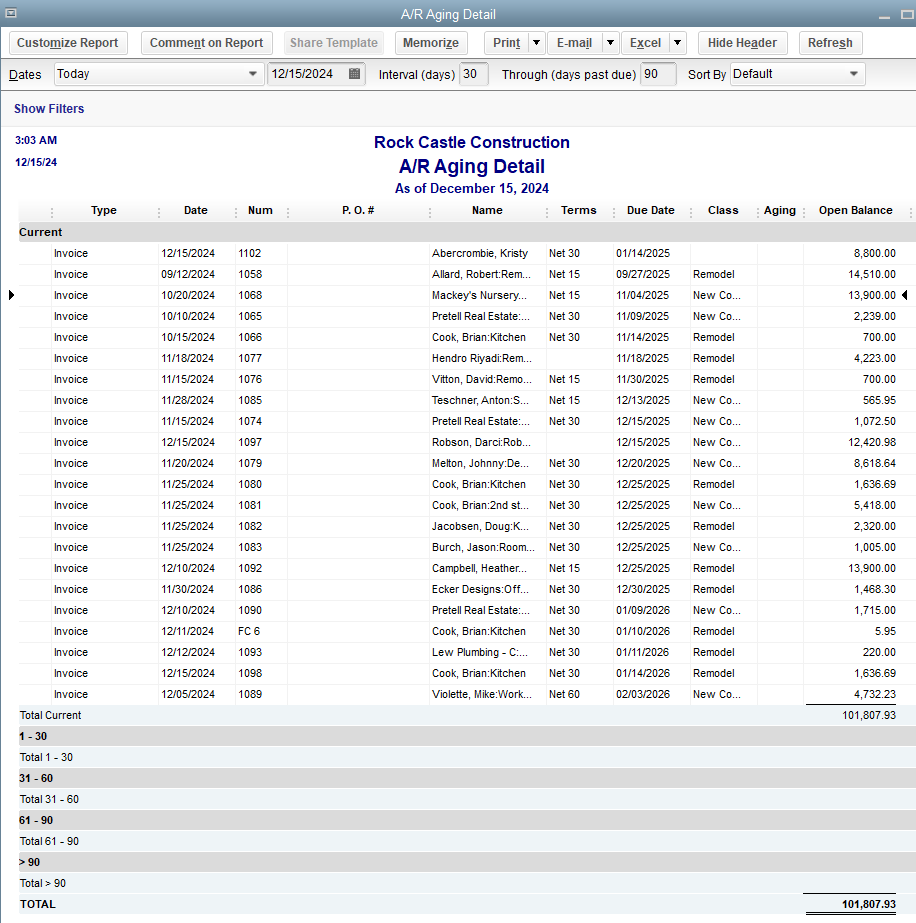

Accounts Receivable Aging Report

The Amazing Custom Reports In Quickbooks Online Instructions Pertaining To Quick Book Reports Templates Photo Bel Quickbooks Online Quickbooks Best Templates

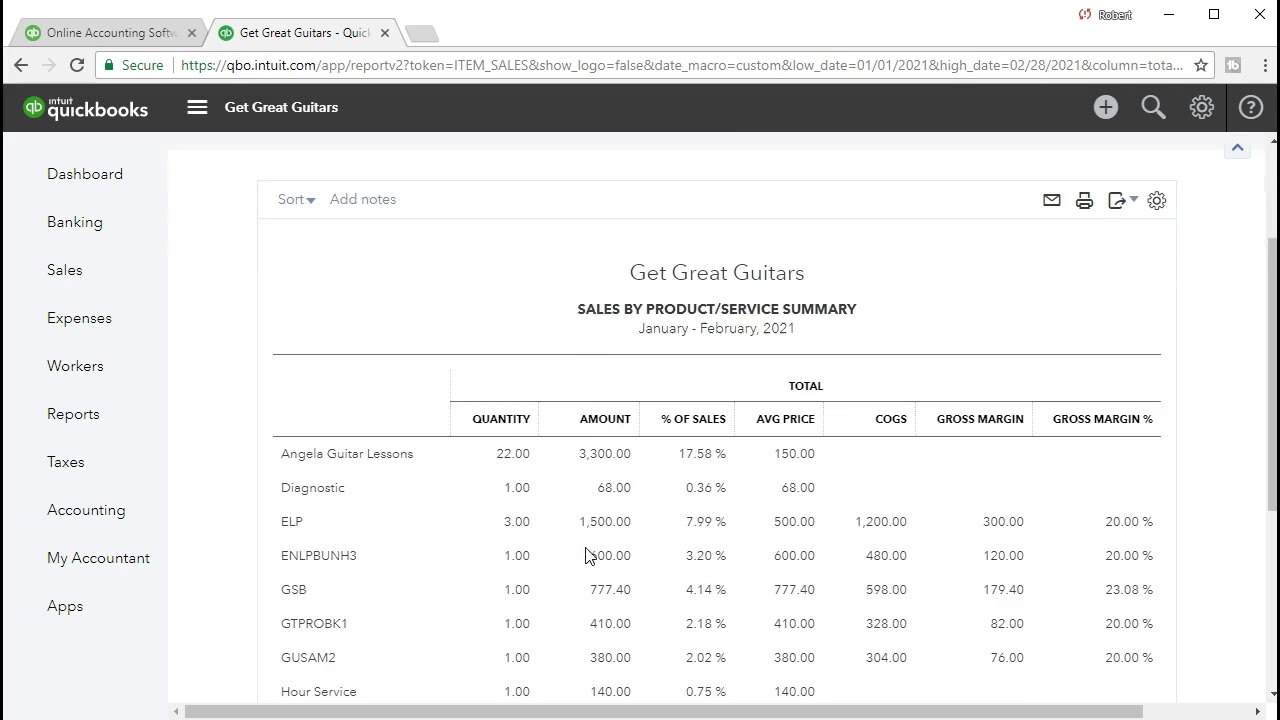

Quickbooks Online 4 25 Sales By Item Summary Report U Youtube

Looking For A Detail Report Of An Owner S Equity Account On 2019 Mac Desktop

Oh Quickbooks You Truly Know The Way To My Heart Is A Big Green Check Mark Office Work Is The Least Glamor Quickbooks Online Quickbooks Small Business Owner

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com